For IR Websites in the Muni Bond Market, Mobile Matters

July 19, 2016

While not as prevalent as issuers in the corporate bond/equity markets, municipal bond issuers are devoting more and more resources to the development of dedicated investor relations (IR) websites to connect and communicate directly with bond investors. These platforms allow issuers to provide more information to investors about who they are and what they do, including public documents and data, and make a social connection between the bonds and the capital projects that are being bond-financed. They can also provide a boost to the compliance aspect of issuer disclosure from a regulatory perspective. In response to the growing trend of municipal IR websites, last year the Government Finance Officers of America approved a best practice for its members called “Using Technology for Disclosure” that encourages issuers to use dedicated IR websites to communicate with the municipal bond market.

The purpose of IR websites is to attract more investors to the issuer’s bonds. Better disclosure can lower the yields on bonds, lead to more stable bond valuations, and result in more trading activity and liquidity in the secondary market. The idea is to make it as easy as possible for investors to find out more information about the bonds. But in order for an issuer to provide productivity gains to investors, the IR website has to be designed in a way to meet the changing credit surveillance behavior of investors. Not only should an IR website be visually engaging and easy to navigate, but the platform should be flexible enough so that investors can access key documents, presentations, the finance calendar, etc. using any type of device. It may not seem obvious, but many investors do their investing research using devices other than desktop computers. According to a study by Rivel Research, 67% of corporate investors surveyed accessed corporate IR websites via tablets. 63% said they regularly accessed sites using phones. In terms of the types of devices used, Apple tablets and phones were the most popular of the investors surveyed.

The need for IR websites to provide investors with access to data on all types of devices is probably even greater just based on the fact that much of the outstanding municipal bonds are held by individual investors. Federal Reserve data regularly show that roughly 70% of municipal securities are held by individuals either directly or through mutual funds.

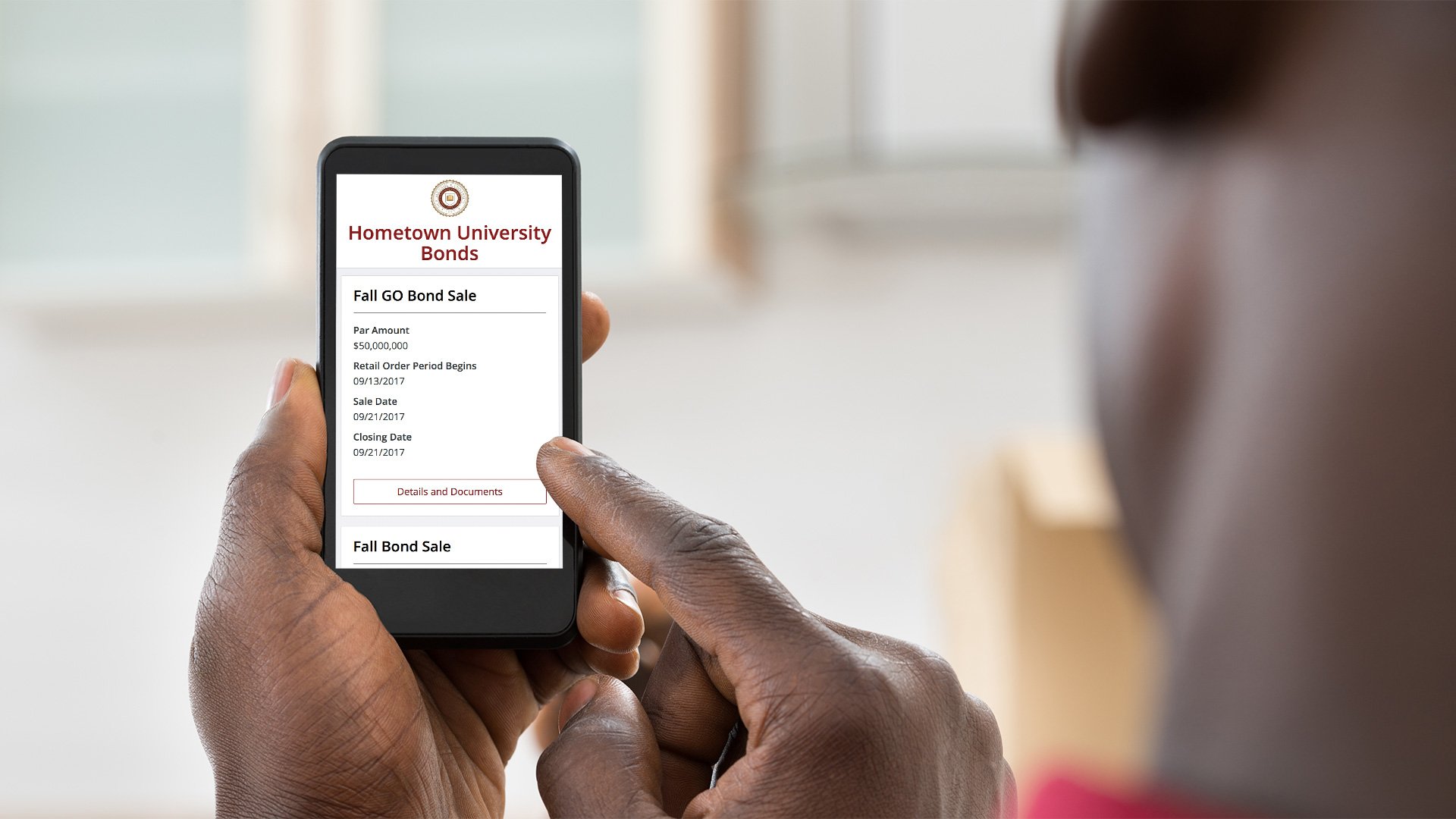

Responsive web design refers to websites that "respond" to the device on which they are being accessed. In short, as an issuer you want an investor’s experience – including its access to documents, data and other tools – to be just as useful whether they are an institutional investor accessing your website from their desktop terminal or a private wealth advisor accessing your website while presenting to his/her clients. With fully responsive web design, an IR website’s content is optimized and is as easily available via a large screen like a desktop computer or a small screen on an iPhone.

Try it out for yourself. On your phone or tablet, visit a fully responsive corporate site like the Microsoft investor relations website (https://www.microsoft.com/en-us/investor). You will notice that the company is still able to provide a wealth of content to investors no matter the size of the screen of the device accessing the site. Documents, stock quotes, and financials are all visible and accessible when using a phone.

The key take-way for municipal issuers: mobile matters. It is a certainty that existing and potential investors are researching issuers and conducting credit surveillance via mobile devices. If your goal is to be a leader in disclosure in order to attract as many investors as possible to the next bond sale, build in the necessary flexibility to your IR website. Don’t ignore the huge pool of investors – many of whom may be individual investors – who shop for bonds like they shop for new cars or houses. When there is so much competition for low-cost capital in the municipal market, you can’t afford to have an IR website that does not offer tools to investors across all devices.

In our next post, we’ll talk about how IR websites democratize data in the municipal bond market.