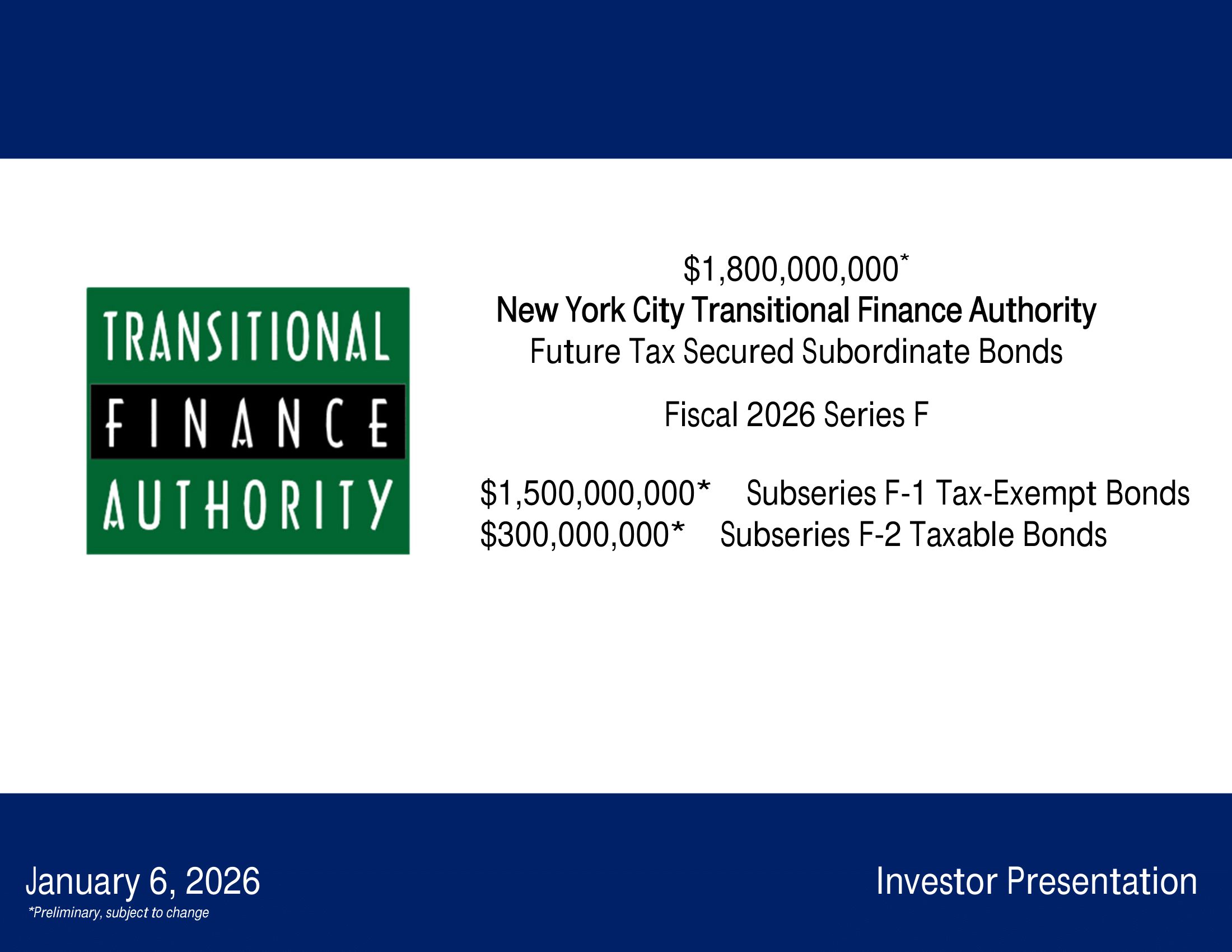

Future Tax Secured Subordinate Bonds, Fiscal 2026 Series F, Subseries F-1 and F-2*

Offering Summary

Future Tax Secured Tax-Exempt Subordinate Bonds, Fiscal 2026 Subseries F-1

- Par Amount

- $1,500,000,000

- Tax Status

- Tax-Exempt

- Sale Date

- 01/14/2026

- Sector

- County / City / Town

- State

- New York

- Bond Type

- Fixed Rate

- Method of Sale

- Negotiated

- Closing Date

- 02/03/2026

- Retail Order Period Begins

- 01/13/2026

Future Tax Secured Taxable Subordinate Bonds, Fiscal 2026 Subseries F-2

- Par Amount

- $300,000,000

- Tax Status

- Taxable

- Sale Date

- 01/14/2026

- Sector

- County / City / Town

- State

- New York

- Bond Type

- Fixed Rate

- Method of Sale

- Competitive

- Closing Date

- 02/03/2026

Offering Documents

Disclaimer: Prospective investors should carefully review the Official Statement. Offers to purchase the bonds can only be made through a registered broker-dealer and through an Official Statement.

Other Issuer Documents

Additional Information

*Preliminary and subject to change

Ratings

Bond Offering Ratings

Roadshows

New York City Transitional Finance Authority Future Tax Secured Subordinate Bonds Fiscal 2026 Series F Investor Presentation

Offering Participants

Book-Running Lead Manager

Ramirez & Co., Inc.

Co-Senior Manager

Co-Manager

Academy Securities Inc.

Barclays

-cropped.png.hMFmNv1Oc.png)

Blaylock Van, LLC

BNY Mellon Capital Markets, LLC

Cabrera Capital Markets

Drexel Hamilton, LLC

Fidelity Capital Markets

-cropped.jpeg.YAtqVbw4U.jpeg)

Goldman Sachs & Co.

Great Pacific Securities

Morgan Stanley

-cropped.png.FQoVRz5pf.png)

Oppenheimer & Co. Inc.

Raymond James

Rice Financial Products Company

Roosevelt & Cross Inc.

Stern Brothers & Co.

Stifel, Nicolaus & Company, Inc.

TD Financial Products

-cropped.jpeg.WC4fNHczh.jpeg)